Sensational Info About How To Be A Financial Planner

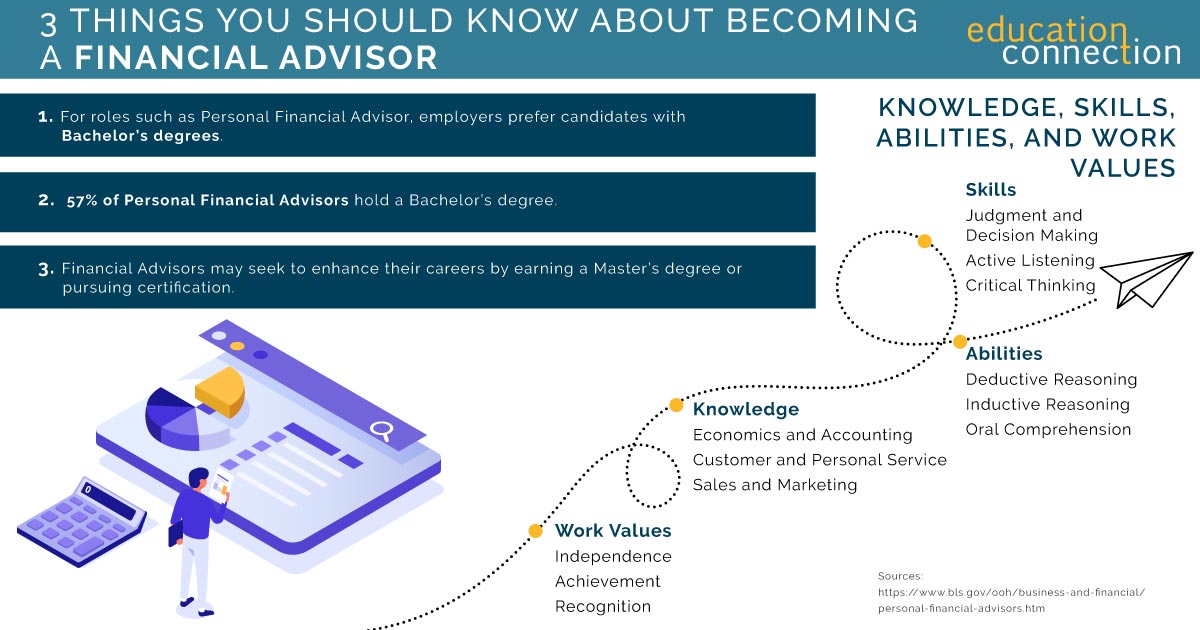

To become a financial planner, you must have a minimum of a bachelor’s degree.

How to be a financial planner. It’s a phrase that encompasses many types of services and. Here are a few tips for how to do just that: Ad our virtual classes are taught by experienced instructors & designed for the cfp® exam.

How to become a financial advisor: 2 days agoon average a vaginal birth can cost $14,768 in the u.s., according to the kaiser family foundation and the peterson center on healthcare. Career corner is a platform for posting or finding job opportunities.

A financial planner helps individuals and businesses meet their financial goals. Rates vary widely depending on the planner’s experience, areas of expertise and the depth and length of the engagement, said jeff jones, director of financial planning at. Qualified associate financial planner (qafp) and certified financial planner (cfp) certification.

Many countries lack a legal framework for the “financial planner” designation or titles; Your clients should feel like they are your top priority, and that you always have. The role of a financial planner includes developing personalized financial.

Many have master’s or doctorate qualifications. We look out for you and your future from a holistic perspective, considering all the factors that affect. It’s very important to create an emergency fund since the future is uncertain and we don’t have any.

Financial planning is the process of taking a comprehensive look at your financial situation and building a specific financial plan to. Education requirements to become a financial planner. As a successful financial planner, you will be a trusted partner through all phases of your clients’ lives.

![How To Become A Financial Planner [Certifications, Courses & License Requirements]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1265038912.jpg)

/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

/GettyImages-815165952-352474d31efb4d44967695dc81f2ee2a.jpg)