Fun Tips About How To Avoid Mortgage Points

Therefore, 100 basis points equal 1%.

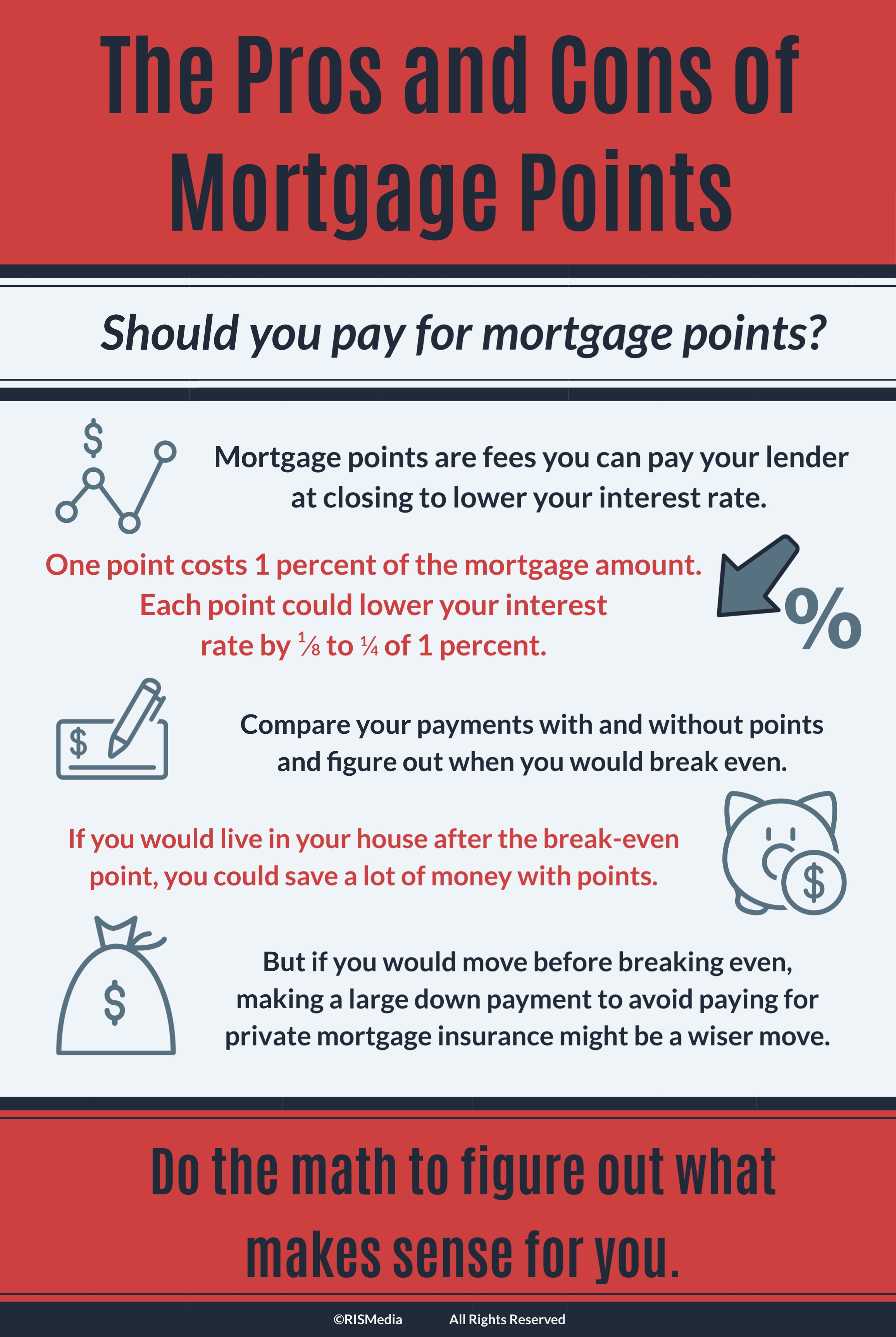

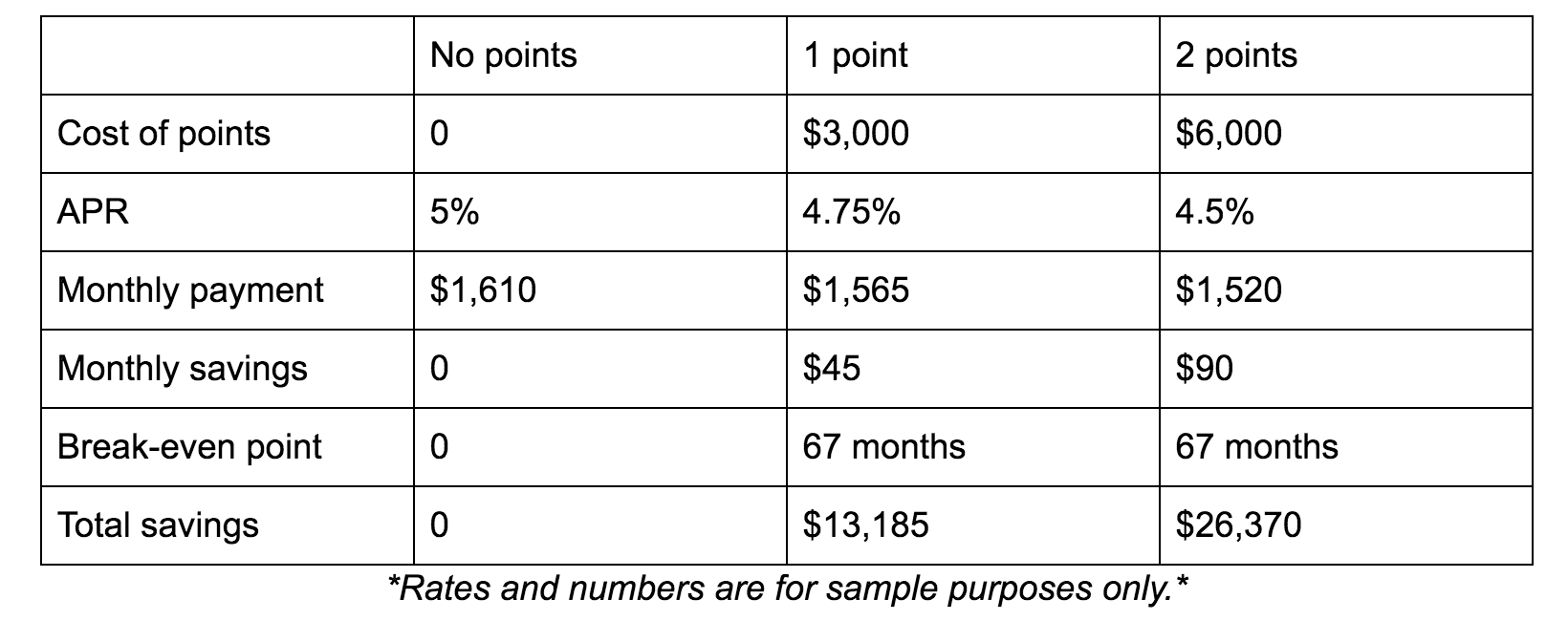

How to avoid mortgage points. For example, let's say you qualify for a 5.5% interest rate. Again, one point is typically equal to 1% of the loan principal and generally reduces the rate by. Don’t choose a (nearly) permanent solution to a temporary problem.

If you itemize deductions on your returns (as many homeowners do), you can write off the amount of money you spend on mortgage points along with any mortgage interest you. Fall prey to the value of the mortgage. Mortgage points, also known as discount points, are a form of prepaid interest.

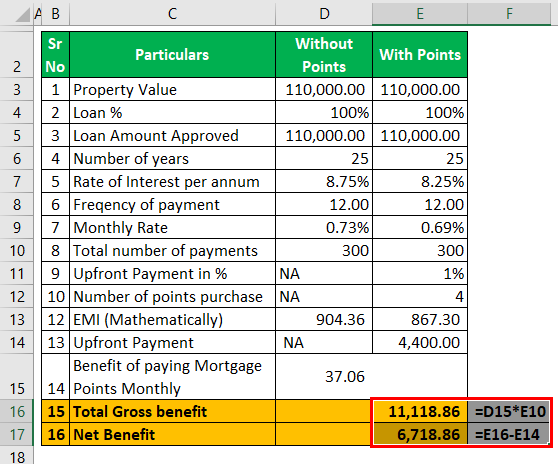

Make a larger down payment to keep your principal. This certainly makes sense if you are planning on. By contrast, one discount point equals 1% of the loan amount.

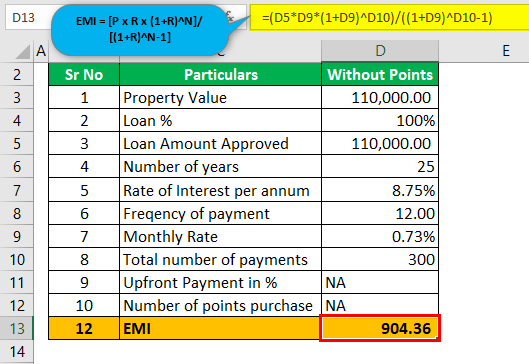

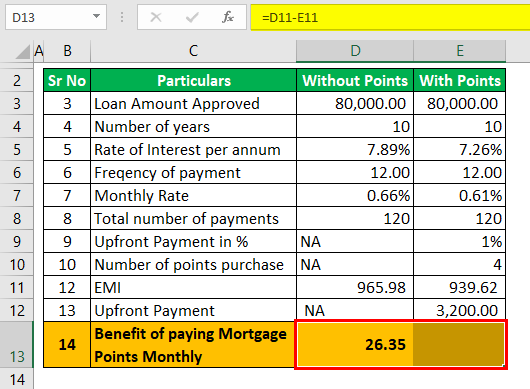

Discount points cost roughly 1% of the loan amount per point. Purchasing the three discount points would cost you $3,000 in exchange for a savings of $39 per month. One point costs 1% of your loan amount, or $1,000 for every $100,000.

You can't buy them afterward. Whenever an asset or a property is to be mortgaged. Also, most lenders allow borrowers to.

Talk yourself down from that ledge. Most refinance loans have a lower interest charge, negating the initial investment on the discount. With home sale prices averaging well over $400,000 nationally, however, this.