Fantastic Info About How To Find Out Cost Of Goods Sold

Cogs is equal to the sum of the beginning inventory plus additional inventory minus.

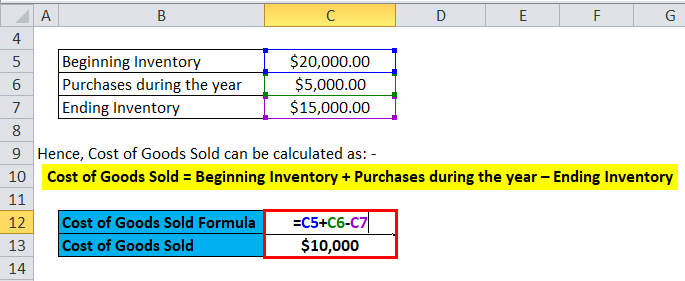

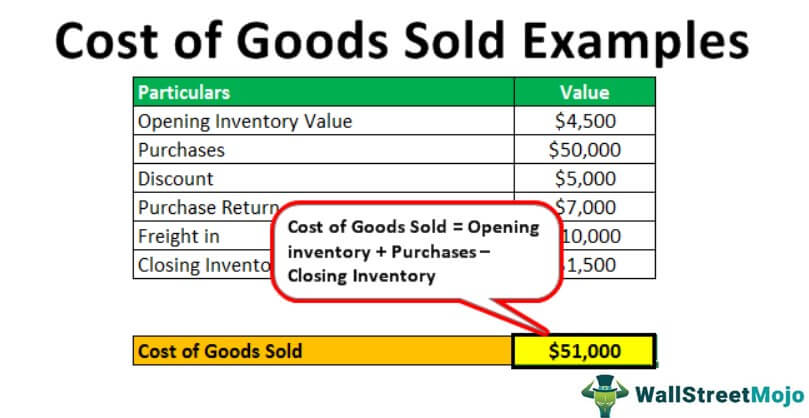

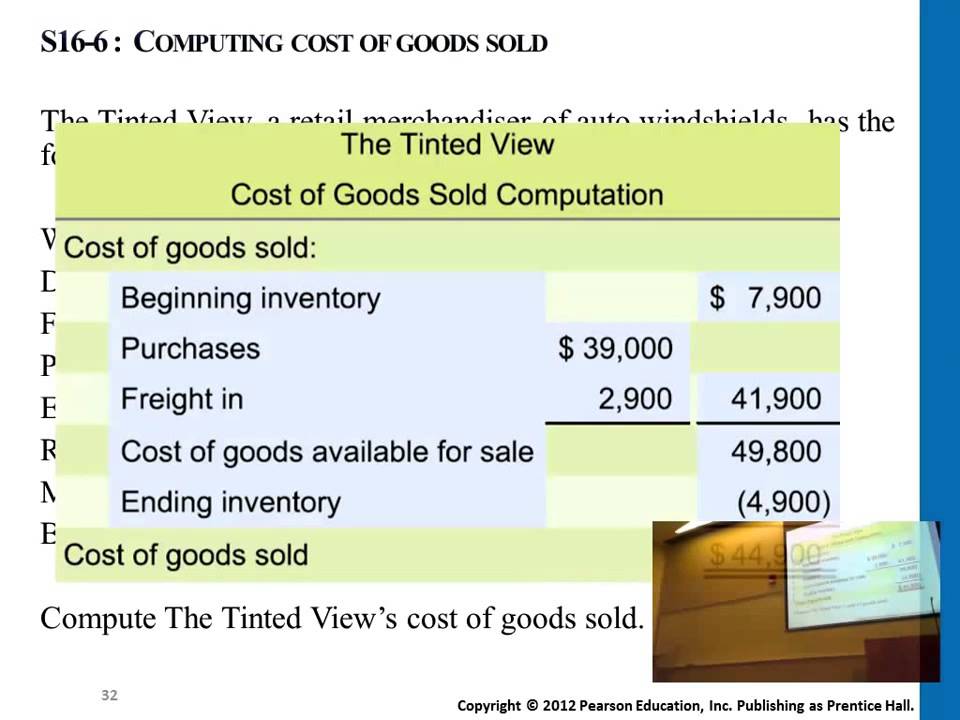

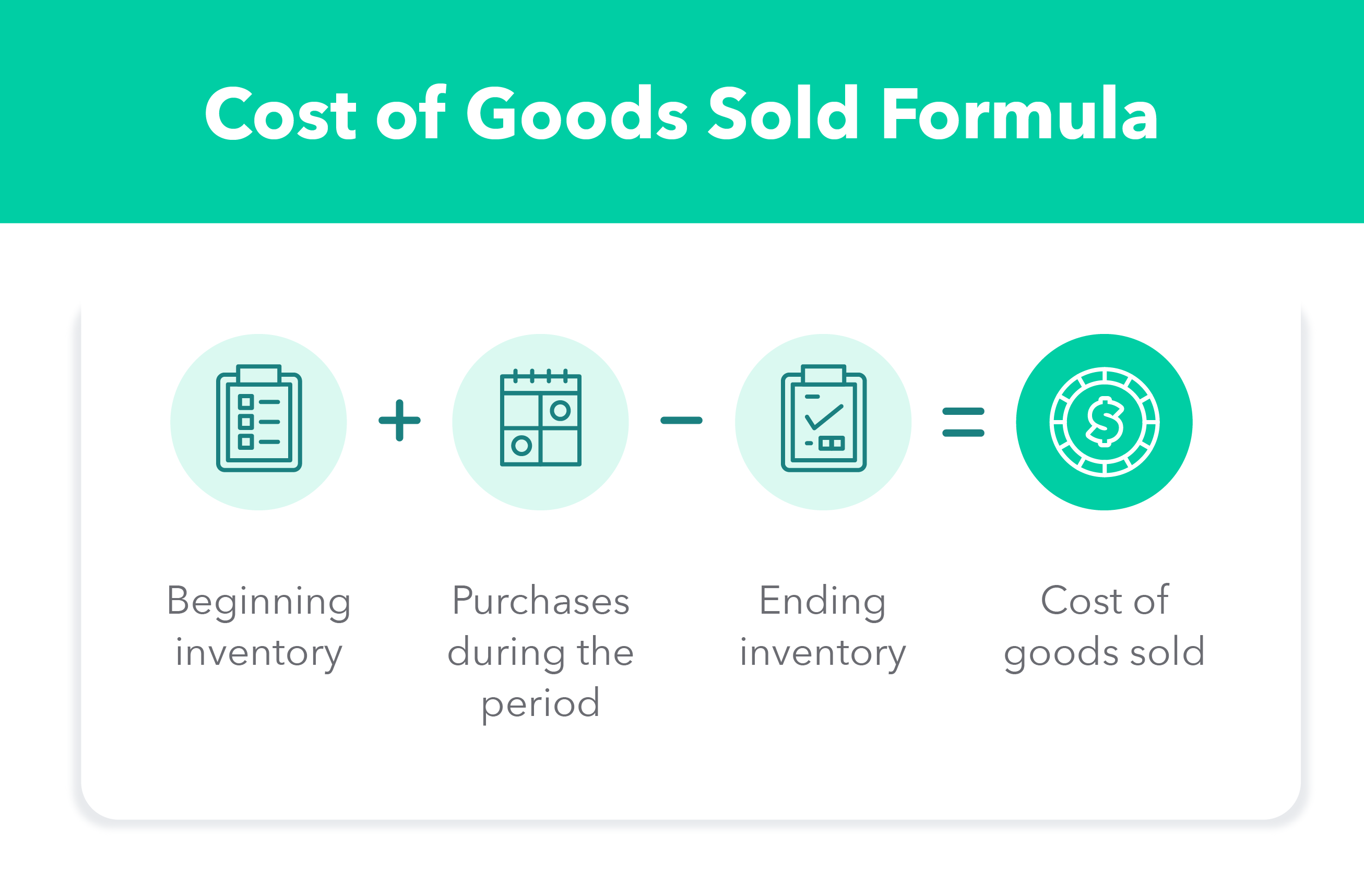

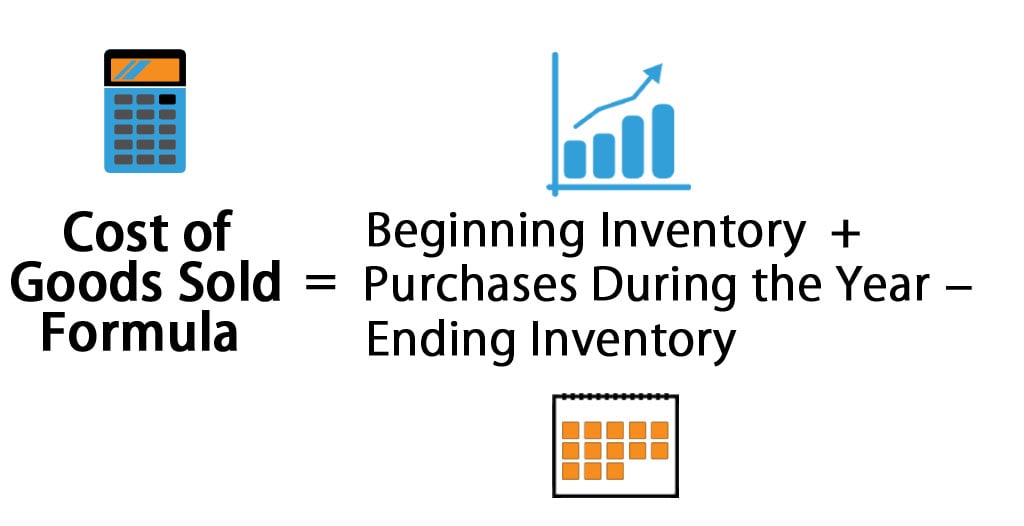

How to find out cost of goods sold. Starting inventory + purchases − ending inventory = cost of goods sold. The cost of goods sold formula is simple to use. Here’s the general formula for calculating cost of goods sold:

Cost of goods manufactured for the year. If the formula is confusing, think of it this way. To make this work in practice, however, you need a clear and.

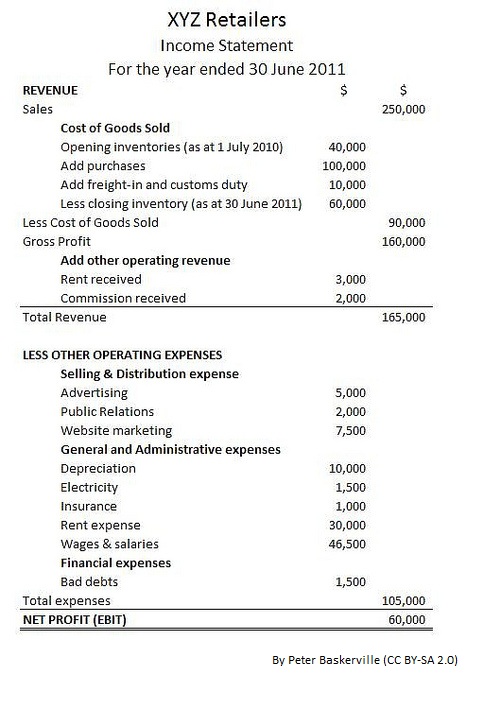

You can get the final cost of goods sold by using the following formula: How to calculate the cost of goods sold. A simple formula to calculate the cost of goods sold is to start with your beginning inventory.

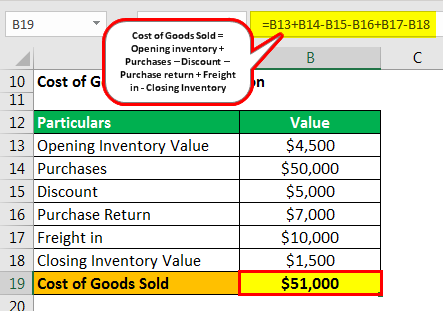

To make this work in practice, however,. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company.this amount includes the cost of the materials and labor directly. Essentially, to get the cost of goods sold, you add the beginning inventory and the additional inventory costs, then subtract the ending inventory value.

Cost of goods sold formula. At the beginning of the year, the beginning inventory is the value of inventory, which is actually the end. At a basic level, the cost of goods sold formula is:

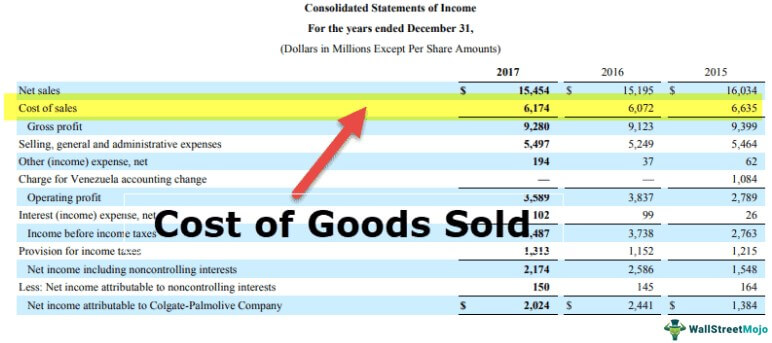

The cost of goods sold is how much a business's products cost to buy or produce. What is the cost of goods sold formula? Cost of goods sold (cogs) is calculated by adding up the various direct costs required to generate a company’s revenues.

/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)